Something I’ve found interesting to watch over this bubble is the way language around real estate changes and how that plays into people’s psychology. I see catchphrases that fly around that spike fear into the hearts of buyers, prod their self-esteem, trigger their sense of competition. It’s also interesting how some are old, battle-worn phrases and some are new entrants.

Truth is, emotions sell, it’s a well known marketing tactic.

Once you see the home buying process as winning or losing, you definitely don’t want to step away from the market. Because we have a word for that, too. It’s called being a quitter.

In fact, let’s go over some common marketing tactics first so we can recognize them in the catchphrases.

- Fear Appeal – This is where you make the subject aware of a threat, show them an action they can use to protect themselves, give them a way to take that action.

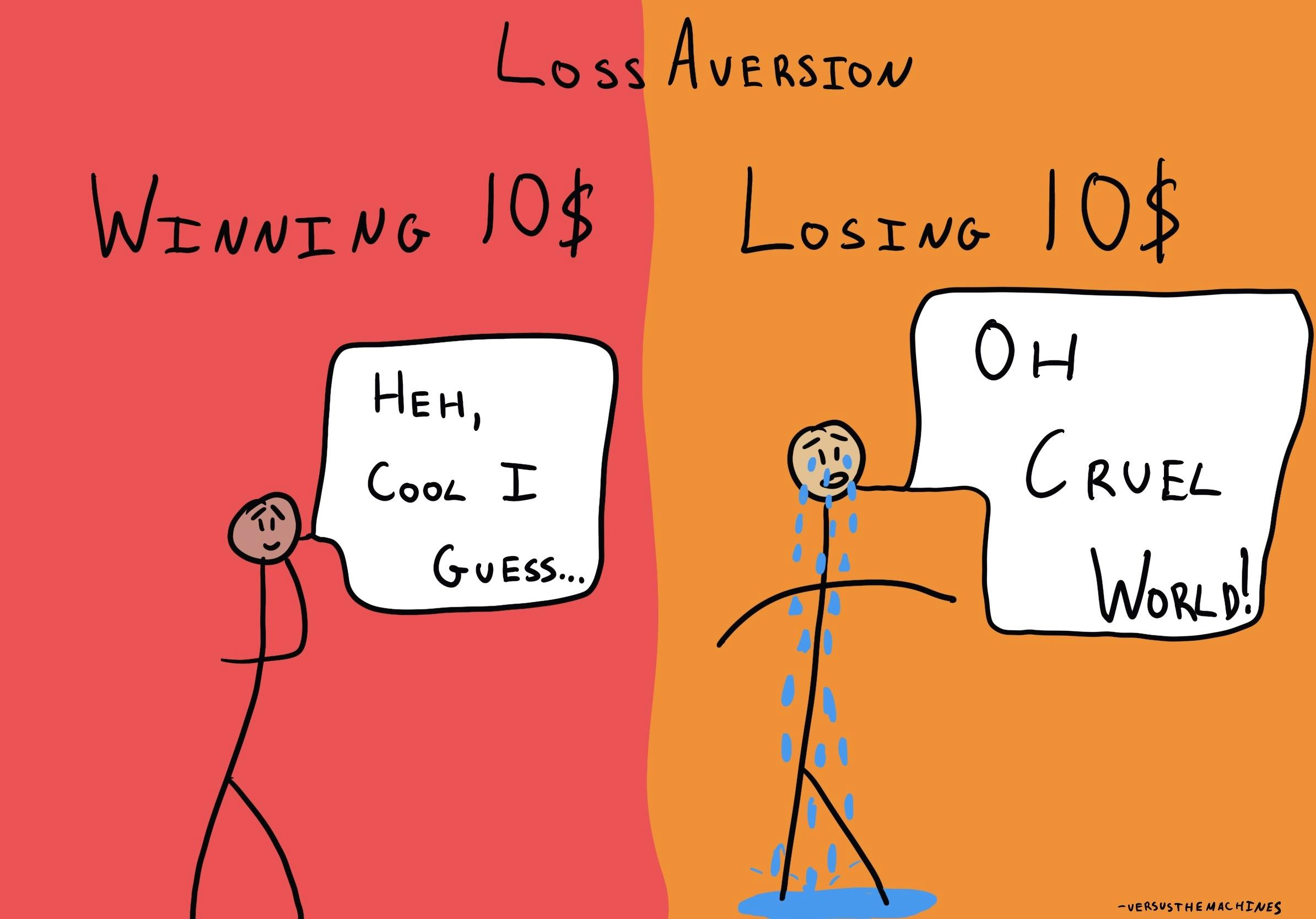

- Urgency – This is where you create a deadline, or sense of urgency. This prompts people to feel they must act quickly or they will lose out. Ever heard of FOMO? That falls right in here. Losing out triggers “loss aversion” as well.

- Loss Aversion – This is a cognitive bias which makes us respond more strongly to the idea of loss than of gain, twice as strongly in fact.

- Aspiration – This is an attempt to make you believe you can be a different better person, the kind of person with a million dollar house.

Buy now or be priced out forever

This is an oldie but a goodie. Classic fear appeal –

- Make the target aware of a thread: “You could be priced out forever!”

- Show them an action they can take: “Buy now!”

- Give them a way to fix it: “I, your friendly realtor, am on your side and can help you fix this.”

It was a mainstay of the 2006 real estate market, and if you look back, you’ll find that hey, no one was priced out forever after all. In fact, many who did buy at the top were priced in for a decade, unable to sell because they were underwater.

Sometimes, you’ll just see the words “priced out” but they evoke the same feelings. Something is in your reach but is getting away quickly. Whether or not this will be true for a particular buyer is besides the point. What it does is inspire fear of forever being left behind and there’s also a sense of urgency in there.

Generational Wealth

This is a new one to me! I think this one is aspirational. When I hear the phrase “generational wealth”, I’m imagining like the Rothschilds or something, people who just inherited massive amounts of wealth and now sit around on yachts sipping champagne all day. This is aspirational marketing at it’s best.

Is this going to be you after you buy this overpriced 3/2 with no contingencies? Yes, it could be! Just imagine!

But no – this is more likely to be your life here on out as you try to spring for a new roof, foundation and plumbing after wiping out your savings on an “unexpected” appraisal gap.

Another way this works, is that people want to give their children security they didn’t have. It triggers parents’ desire to set their children up for success, especially if their own parents don’t have an inheritance to pass on to them.

Winning a house

This is another new one. I have a lot of friends who bought their home prior to his bubble, and what they said to me was, “Hey, we bought a house!”

But recently, what I’ve been seeing everywhere is people say, “Yay, we won a house“!

Or alternately, “What do we need to do to win this house?”

Hmm, why the change of phrase? Because winning triggers a bigger emotional response. Everyone wants to be #winning. This is loss aversion at play. No one wants to be a loser. Despite the fact that if your offer is not accepted, in financial terms, you haven’t lost anything at all.

Even better, once you see the home buying process as a competition, you definitely don’t want to step away from the market. Because we have a word for that too. It’s called being a quitter. And if you thought being a loser was lame then I have news for you. Nobody likes a quitter!

Even if it’s irrational, the psychology around competing makes people bid higher and higher. The funny thing is, by participating in a bidding process, the winner actually ends up being the loser. Because they have effectively paid more than what every other buyer deemed was fair value for this house.

This is called the winner’s curse. Here’s more on that:

The winner’s curse is the tendency for the winning bid to exceed the worth of an item. The person who wins the bid overestimates its worth the most, as they were willing to go above and beyond what a presumably rational person is willing to bid. So, the fact that they won means they paid more than the item is actually worth in the market, as they pay more than other people have valued the item at.

– The Decision Lab

Congrats, you’re now the winner of a house that no one else thought was worth as much as you did!

Renting is throwing away money

This is one that gets me because I’ve thrown away a LOT of money. I’m 43, been renting since I was 21, I’m throwing money away like I have generational wealth.

I’m not sure which marketing tactic this is to be honest. But every rent vs. buy calculator in the world says renting is smarter in cities like San Diego and San Francisco, which is where I’ve lived.

Not to mention, did you know that the way loans work, you will be throwing away money on interest for a long long time?

Here’s some quick math on my situation. I pay $2300 for a 2 br apartment right now – it’s about 1000sf with a deck and private garage. Interest on a mortgage payment, were I to buy something similar in a house right now, would be $3300 on that first payment. Yes, just interest. In fact, only $800 would go towards principal.

And guess what, for that $2300, I get free maintenance, appliances, water, trash and I can walk away from it at any time. All of which I’d have to pay for on top of the $4,100 I’d be paying monthly.

And in case you’re thinking well, eventually you’ll be paying less interest. It would take 15 years before I would get to throw away just $2300 a month on interest.

So no, renting is not just throwing away money, it’s paying for shelter. There are times when buying is the better financial decision or better personal decision, but it’s not stupid to rent. Do the math for your own situation. Use an amortization calculator.

You can’t time the market

This phrase comes from the investing world and refers to the fact that if you invest regularly in diversified funds in the US stock market, on average over the long term you will do better than trying to time entry and exit into the market. Index funds allow you to invest in 100s of companies at once.

It’s especially highlighted as a good way to beat those who pick stocks in specific companies. Why? Because no one failure of one company will significantly affect you if you are diversified across the whole market. Any one company can go under, but the overall US market is unlikely to completely fail (and if it does, money probably won’t save you).

Trying to reuse that advice to encourage buyers to YOLO on a single house in a single neighborhood, and dump all your savings into it is … hilarious.

It’s basically the opposite of the original meaning.

Buying a house is about the biggest, most un-diversified, highest risk purchase most people will ever make. Unlike stocks, it impacts your life choices, personal safety, and daily happiness as well. You should absolutely time and plan this purchase so as not to completely screw yourself over.

Disclaimer: I’m an idiot first time home buyer. I’ve never taken an econ class in my life. I’m just sharing what I see and learn as it happens. I am 100% certain I will get things wrong, so don’t take any of this as the golden truth.