I stopped my search for a house in March of this year, largely because the Fed promised to raise rates, stop the program of QE (Quantitative Easing) and switch to QT (Quantitative Tightening). And happy to report, the Fed kept its promise, this month the Fed started QT in a big way.

What is QT?

First – a quick look at QE. In layman’s terms, quantitative easing is a policy of injecting money into the economy, usually to spur on a weak economy, like we had after the Great Recession. The Fed basically adds new money to the economy by buying treasuries and mortgage-backed securities (MBS). It has the effect of increasing the money supply and encouraging lending by making it easier to get credit.

So you can imagine what happens when this goes in reverse. Demand for housing is destroyed, inventory builds and prices fall.

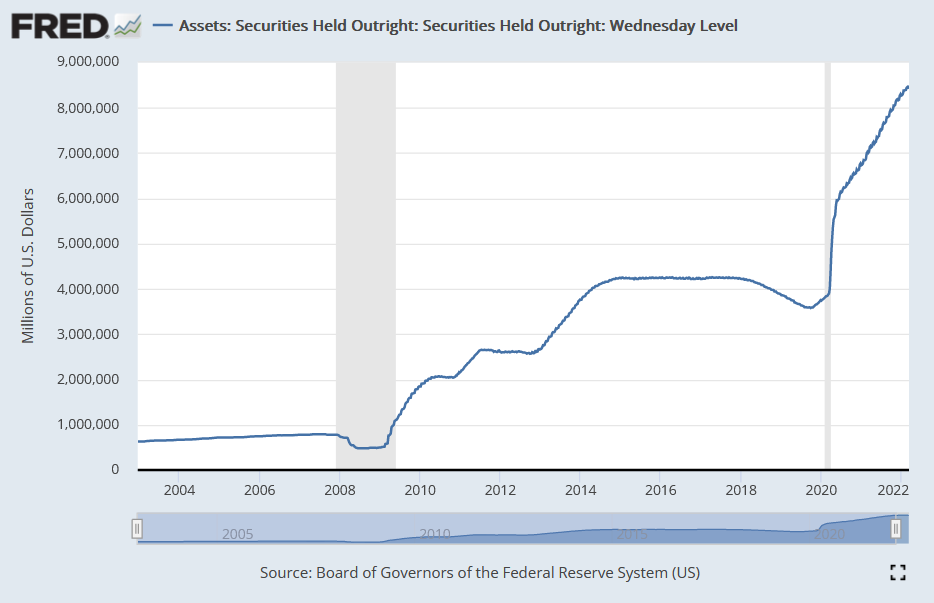

You can see how much money is added by looking at the Fed’s balance sheet. Think of it as “the money the Fed has added to the economy”. This is the balance sheet on March 9th.

As you can see, the Fed really started doing this in earnest after the Global Financial Crisis (GFC) in 2008. And while it tried to reduce the balance sheet around 2018, it never quite managed to make much headway.

Notice that rocketship after 2020? When COVID-19 hit, the Fed went gangbusters on QE. This, in addition to zero interest rates, juiced the economy and stimulated demand for everything, stocks, cars, crypto and of course, housing.

Want to learn more? Here’s a great article on QE.

What now?

Well, that date March 9th, represented the last QE purchase the Fed would make. That is, they stopped increasing the balance sheet and promised to start decreasing in June. That was the week I stopped looking to buy a house.

Decreasing the balance sheet is called Quantitative Tightening. Essentially the Fed allows the treasuries and securities it purchased to mature each month without replacing them. This runs off the balance sheet without them having to actively sell these treasuries or MBS.

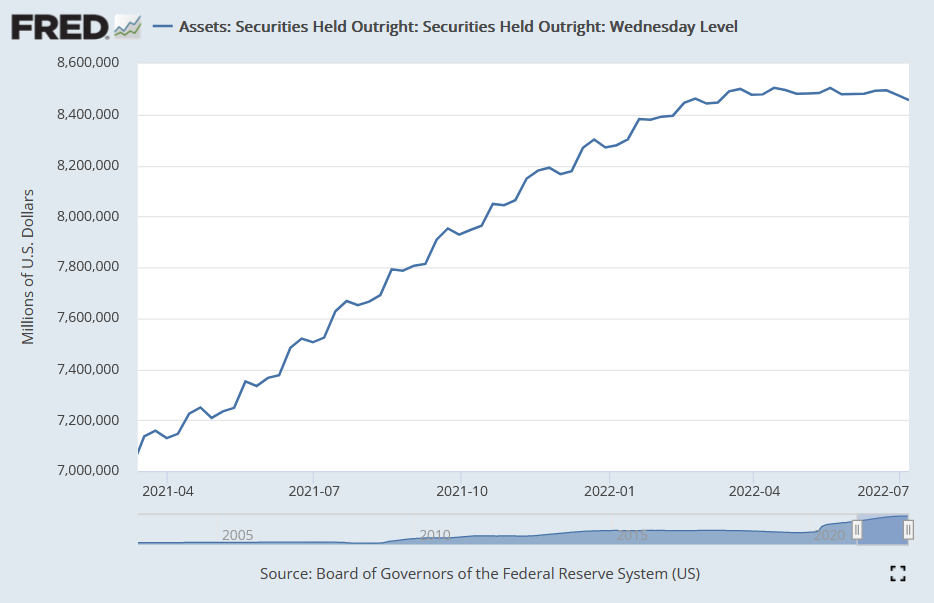

So here we are, on July 7th. Did the balance sheet start to decrease? Yes!

Yes, I had to zoom in. And you can barely tell, lol. But it’s happening, they did the thing. It doesn’t look like much but as of the week of July 6th, the balance sheet has fallen by $74 billion from the peak.

And this is considered “starting slow”, the Fed intends to decrease the balance sheet faster over the first few months. So the new era of QT has begun.

What does this mean for housing?

Well, if QE stimulates demand, QT destroys demand.

When the Fed injected trillions of money into the economy, demand for housing skyrocketed. Not just for primary homeowners but every investor, airbnb owner, landlord wanted to buy a second, third, tenth house. And with that demand, inventory plummeted and prices soared.

The Fed released a paper admitting as much this past week. They concluded that stimulated demand was responsible for the surge in housing prices, not a lack of supply, which is the story the RE industry would love you to believe.

Read more on the difference between inventory and supply.

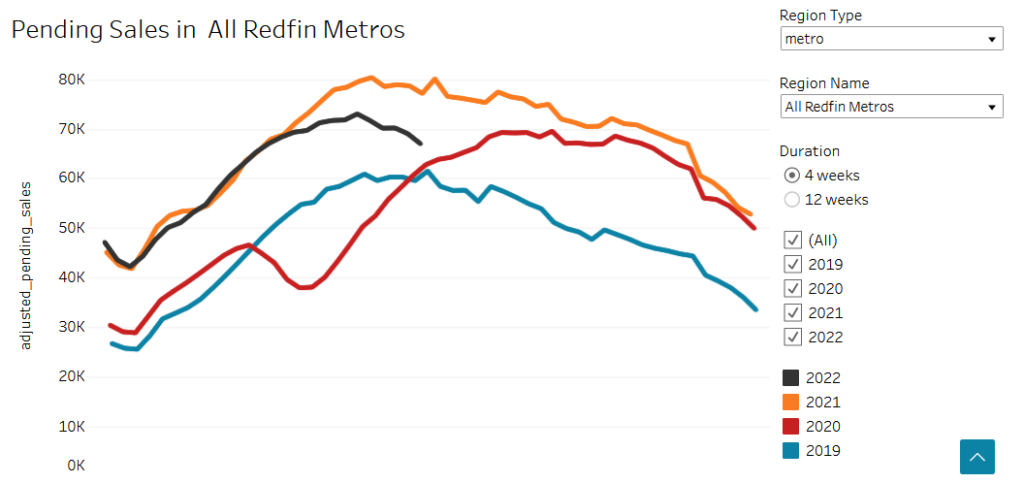

So you can imagine what happens when this goes in reverse. Demand for housing is destroyed, inventory builds and prices fall. In fact, just the fact that the Fed has raised rates and laid out its plan has destroyed housing demand already.

San Diego’s pending house sales dropped 40% year over year in June, according to SDAR. Nationally, pending sales are down 13% according to Redfin.

And across the board, inventory is building back up, fastest in the US West. The grey bar is inventory from 2021 for the week of July 2. The pink line is 2022.

Look at the buildup from 2021 to 2022 (grey bar vs. pink bar) for each region.

As I described a while back – low inventory would not save the housing market once the Fed’s tightening takes effect.

Almost every component of demand and supply experienced massive short term effects due to the Fed, Covid and the resulting fiscal and the monetary policy. I think it’s fair to assume these short term effects will start to dissipate, if they haven’t already, as the Fed’s tightening actions take effect.

– Low Inventory Won’t Save the Housing Market

It’s fair to say things are proceeding as expected. And with the advent of QE, this should only continue in the same direction. Once inventory builds to normal levels, as long as the Fed doesn’t pivot to easing again, prices will fall.

Disclaimer: I’m an idiot first time home buyer. I’ve never taken an econ class in my life. I’m just sharing what I see and learn as it happens. I am 100% certain I will get things wrong, so don’t take any of this as the golden truth.