Well, this has been an exciting week. Last Wednesday, the chair of the Federal Reserve, Jerome Powell, as much as said to home buyers – Wait, just wait for the market to reset. This is exactly what we stopped our search for, and it was validating to hear the Fed say so.

Why does the Fed matter

The Fed controls the rates at which banks borrow money and therefore, the rate at which they lend money to all of us. In addition, since 2008, the Fed has engaged in something called quantitative easing which essentially injects more money into the economy. Lowering rates and injecting money i is done to stimulate the economy out of a recession, because it lets people borrow more and afford more.

As I learned looking into this a few months ago – this cheap money really juiced the housing market and earlier this year they announced their plan to pivot and change direction.

Why? Well the Fed’s job is actually to keep inflation at a low rate (about 2.5%) and keep unemployment low. Currently unemployment is very low (good job on that) but inflation is at a 40 year high. So they are failing on this part of the job.

What the Fed said

So, then what did they say that was so exciting? For one, they increased the Fed funds rate by 0.75% instead of the .5% that was expected from previous speeches.

And then he said all of the above with respect to housing, that low rates juiced the housing market and well, he plans to turn that around. Emphasis mine.

We saw [home] prices moving up very very strongly for the last couple of years. So that changes now. And rates have moved up. We are well aware that mortgage rates have moved up a lot. And you are seeing a changing housing market. We are watching it to see what will happen.

How much will it really affect residential investment? Not really sure.

– Jerome Powell, June 15, 2022

How much will it affect housing prices? Not really sure.

Obviously, we are watching that quite carefully…

“Not really sure”. I LOLed at that because of course they know what it will do, but they won’t say. Obviously they don’t know prices will fall a certain percentage, but I do believe they know that they will. But that’s the part they can’t say out loud.

A nice extra – he went on to describe what points to price declines but caught himself and balanced out with the bull case.

You’d think over time…There is a tremendous amount of supply in the housing market of unfinished homes, and as those come online…

Whereas the supply of finished homes, inventory of finished homes for sale is incredibly low, historically low. It’s still a very tight market, and prices might keep going up for a while, even in a world where rates are up. So it’s a complicated situation and we watch it very carefully.

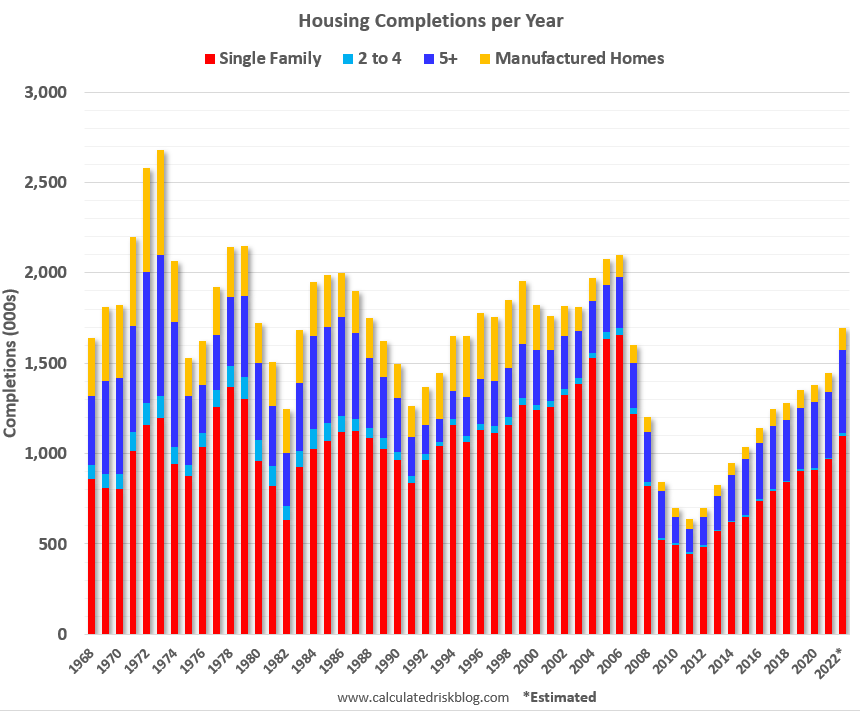

What supply of unfinished homes? What he’s talking about is the largest number of home completions in a year since 2006, all set to come online in 2022. That’s this year, within the next 6 months!

He’s very aware of what this means, despite the ongoing RE market line that there is so much pent up millennial demand that isn’t going away.

Finally, and this is the best part, he spoke directly to home buyers.

I’d say if you are a homebuyer, somebody or a young person looking to buy a home, you need a bit of a reset. We need to get back to a place where supply and demand are back together and where inflation is down low again, and mortgage rates are low again.”

There it is folks, in so many words. Wait.

Do I believe him?

Well, I believe him today. His job is to turn that headline inflation around, and even if he can’t control supply chain issues, he can control the demand side of that equation and that is the only way for him to bring that down. Which means tightening financial conditions, hence the 0.75%.

That said, if he pivots, I will buy but so far he has shown a lot of resolve to stick to the plan, however slowly he is going with it.

Disclaimer: I’m an idiot first time home buyer. I’ve never taken an econ class in my life. I’m just sharing what I see and learn as it happens. I am 100% certain I will get things wrong, so don’t take any of this as the golden truth.