One question a lot of buyers have had to ask themselves lately is, which is better – high prices and low rates? Or low prices and high rates?

We’re coming off from a period where rates were incredibly low, but prices went sky high. And perhaps we’re heading to a period where prices are low, but rates are high. Currently though, it feels like the worst of both worlds – prices are high and rates are high.

It’s not about rates, it’s about buying safely. In spring this year, it felt downright dangerous to buy.

It’s interesting to see on online forums – regret in both directions. People who bought at the peak and regret it now seeing prices fall. And people who didn’t buy, regret it now that rates are going up.

I’m in neither of those camps. I’m okay with higher rates, and it’s not even about rates for me, it’s about risk.

Risk

That’s why I prefer to wait , one word, four letters. R – I – S – K.

And I almost NEVER hear it mentioned when people are discussing which is better. People only talk about the rates and dollars, rarely the risk. It’s important to remember that rates and prices don’t change in a vacuum. There’s a lot of macroeconomic context around why they change and how fast they change that creates an environment in which you make the decision.

For me, it’s not about rates, it’s about buying safely. In spring this year, it felt downright dangerous to buy.

Danger, Will Robinson

So why did it feel dangerous to buy a home this spring?

1. Shocking appreciation

Sure, prices were high, but that’s not the real problem. I mean, I live in San Diego, in some sense, it’s high prices all day, everyday here. I was actually okay with the high prices, I had my 20% down payment, and I was within the lender’s DTI range. I thought, if that’s what houses cost now, that’s what houses cost.

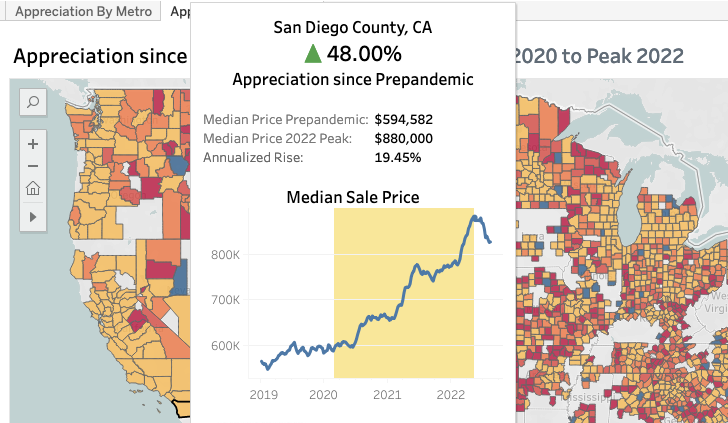

But then I noticed the price histories on homes. Since the pandemic, San Diego has appreciated 48%. That’s an annualized rise of almost 20%. The yellow area marks the rise from Mar 1, 2020 to the peak. Ignore the drop after, pretend you didn’t know that was coming.

A normal amount of appreciation is something like 5% a year. We’re talking 4x that. For two years straight. It’s bonkers. And with that bonkers appreciation, comes a risk of correction. A likelihood of reversion to mean.

If that correction happens, and prices return to “normal”, buyers who bought in this period will be underwater on their loan. For e.g. if you bought at the peak in San Jose with 10% down, you may be already underwater today. Yes – today.

So does record appreciation mean a reversion is more likely? Maybe not everyone thinks that. I do, I’m no economist but the National Bureau of Economic Research (NBER) seems to think it likely. A recent NBER paper said the following:

The combination of rapid credit and asset price growth over the prior three years, whether in the nonfinancial business or the household sector, is associated with about a 40% probability of entering a financial crisis within the next three years. This compares with a roughly 7% probability in normal times, when neither credit nor asset price growth has been elevated.

– Predictable Financial Crises, NBER

I don’t think we can tell when a correction might happen, but it’s fair to assume the risk of one happening rises substantially after a period of rapid, unprecedented appreciation like we’ve had post-pandemic.

Being underwater

As one person, buying one house, with a fair amount of my net worth tied into it, risk is something I have to pay attention to. Because I can’t “diversify” this investment at all.

I’m only buying one house, on one street, in one market, at one moment in time.

If it corrects, my loan will likely be underwater and if there’s one thing I want to avoid, it’s being underwater.

Once you’re underwater, a lot of options disappear.

- You can’t sell without bringing money to the table.

- You can’t refinance

- You can short sale or foreclose, but you’ll wreck your credit and renting will get much harder

- If you lose your job, you’ll probably need to foreclose if you can’t make payments.

- If you keep your job, you’ll be trapped in the house potentially for a decade.

Read this: I bought a condo and it ruined my life.

2. Contingencies Waived

Finance contingencies, appraisal contingencies, inspection contingencies, waive them all!

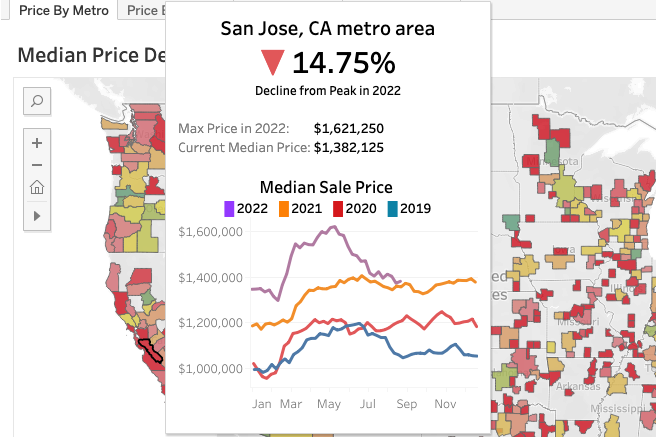

Another very dangerous aspect of this spring, was that everybody was waiving contingencies. Realtors were telling buyers, “Well, you just can’t compete if you don’t waive contingencies”.

Here’s Kevin Grolig, a Real Estate Agent with Compass, giving buyers advice on “how to win a bidding war in 2022.”

Guys, we’re all adults so let’s just keep it real. In today’s real estate market, as the buyer, the chances are great you’re gonna get zero contingencies. Normal contingencies that we see in a normal market like home inspection contingencies, radon contingencies, financing contingencies and appraisal contingencies in today’s market more likely will be a complete no-go.

– Compass Realtor on Youtube

Contingencies are there to protect buyers. An appraisal contingency lets buyers walk away if the house appraises lower than they offered. An inspection contingency lets buyers walk away if the inspection pulls up something terribly wrong with the house.

When you waive your inspection contingency, you could end up buying a house with major problems. Some houses can be real money pits, and this period has been a great boon to sellers trying to offload these houses.

Getting a buyer to waive their inspection contingency on a house with major issues is a jackpot for sellers and a nightmare for buyers. But realtors don’t care, they get to walk away with their 3% so it’s no skin off their nose to advise you to skip contingencies to “win the house”. Maybe they were right, even. That’s what was needed to “win a house” in April. That’s dangerous.

And that’s the same sort of house that won’t sell in a down market. Even if you’re above water.

3. Appraisal Gaps Covered

Another common tactic in this market was for the buyer to cover appraisal gaps. One of the first houses we looked at, I asked the realtor what happens if it doesn’t appraise for what I offer. She said, “Well you’re lucky, you have a large downpayment, so you can just move money from the downpayment to the appraisal gap. It’s the same thing basically”.

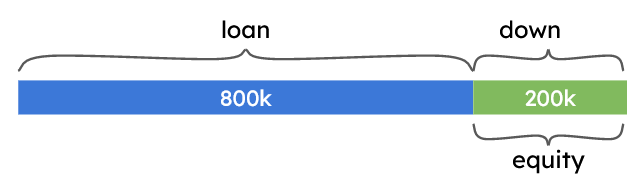

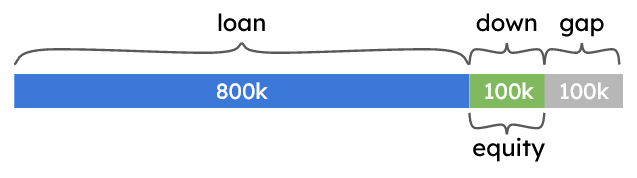

I had just started learning about the buying process and didn’t question it. But I went home and thought about it. It is most definitely not the same thing. Money that goes toward the down payment is considered your equity. But money that goes toward an appraisal gap essentially evaporates. Well, it goes to the seller, but the bank does not consider it part of your equity.

Say you offered $1m on the house, and you had 20% down or 200k. That’s an 80% loan-to-value, and you have 200k in home equity the day you close.

But the house appraises at 900, so with your realtor’s advice, you move 100k from your down to the gap. The loan is now 89% loan-to-value. And on the day you close – you have 100k home equity.

The other 100k? Gone, as far as the bank and your most recent appraisal is concerned.

And yet – realtors were happy to advise you to cover that gap “if you want to compete”.

According to Allison Barnett at EXP Realty in Marietta, GA “Appraisal gap clauses written into offers have become routine. Not only does an appraisal gap clause make it more likely your offer will be considered, but it’s also really the only way to compete in this market.”

– TheMortgageReports.com

The less equity you have, the smaller the correction has to be before you’re underwater, raising your risk of being underwater.

Side note: I ditched that realtor and found another.

4. Overbidding

One thing you’ll notice in all the previous sections is the concept of “competing” and “winning”. The language of home purchasing completely changed during the pandemic. Before this period, I’d never heard someone say, “I won a house”.

When buyers spend more than they intended to, they end up stretching. Their DTI is higher than they hoped, their LTV is lower than they planned, putting them closer to the edge of affordability

Along with this idea of winning, came the concept of overbidding. The list price was no longer the sale price, it was the starting point for bids. This naturally led buyers to spend more than they originally intended to. It was common to offer above ask, and have the seller “counter” with an even higher price.

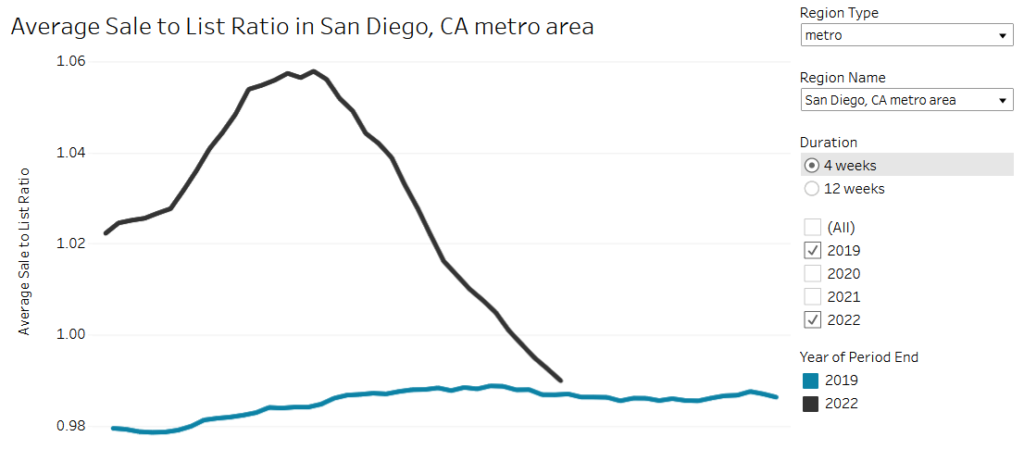

Look at the Sale to List Ratio for San Diego in 2019 vs 2022. On average, homes used to sell below list price, believe it or not. But in April 2022, they rose to 6% over list price. (Notice, it has already dropped to below list).

And that’s just average. One of the first houses I looked at was $900k, and eventually sold for $1.2m, a full 30% higher than the list price. It was not an isolated incident. Sellers were offended! if you offered at or below list.

When buyers spend more than they intended to, they end up stretching. Their DTI is higher than they hoped, their LTV is lower than they planned. This puts them closer to the edge of affordability, and closer to being underwater.

5. Don’t fight the Fed

One final thought, all of the above could be true, and a correction could be nowhere in sight. You could be waiting a long time for a correction. So often it might be right to buy anyway, as long as buyers are aware of and manage their risks.

But when the Fed as much as says we need a correction, and are aiming to fix asset prices, that correction is happening sooner rather than later.

What I’m really saying is that we’ve had a time of red-hot housing market all over the country. Famously, houses were selling to the first buyer at 10% above the ask, even before seeing the house. That kind of thing.

– Jerome Powell, Sep 21, 2022

…

For the longer term we need supply and demand to get better aligned so that housing prices go up at a reasonable level and reasonable pace and people can afford houses again. We, in the housing market, probably have to go through a correction to get back to that place.

Earlier this year, it was not entirely clear what the Fed was going to do, but in early March they put forward a plan for rates and QE. And that was a sign that the Fed was going to destroy demand and likely bring down asset prices.

Fighting the fed is a risky stance to take.

Minimizing risk

Buying a house is an inherently risky thing. Homebuyers are picking a single house, on a single street, at a single point in history on which to make likely the largest financial bet they’ll make in their lives. That this one house will be right for them, in good condition, and they’ll be able to sell when they’re ready to move on.

However, at most times in history, the layers of diligence and contingencies, and the stability of the housing market mean that most buyers will do okay and come out ahead after 5 years or so.

Not so in in the post pandemic housing market. It was far from stable or sustainable. And buyers were forced to engage in risky behavior to participate. All these risks add up to a greater than normal chance of being underwater on your loan.

| Risks → Underwater | Post Pandemic market | Normal market |

| Likelihood of price declines after purchase, due to unprecedented appreciation | High | Low |

| Waived contingencies result in a purchase of a house in poor condition | High | Low |

| Appraisal gaps covered leads to low LTV, equity loss | High | Low |

| Overbidding leading to high DTI, low LTV | High | Low |

So since I can wait, I’m waiting for better prices, lower risk and better buying conditions, even if it means higher rates.

Disclaimer: I’m an idiot first time home buyer. I’ve never taken an econ class in my life. I’m just sharing what I see and learn as it happens. I am 100% certain I will get things wrong, so don’t take any of this as the golden truth.

Thumbnail image attribution: AlexSchulz91