Another month in the wild housing market of 2022 goes by so I’m going to update the sentiment check.

Media

Home prices surged over 20% in March as interest rates also rose

CNBC reports that home prices have surged 20% year over year and that “Rising mortgage rates did not slow down rising home prices in March.”

I wish they’d note that home price data is typically lagging other indicators such as inventory numbers and interest rates. They don’t, but they do end on the following note:

… the macroeconomic environment may not support extraordinary home price growth for much longer. Although one can safely predict that price gains will begin to decelerate, the timing of the deceleration is a more difficult call,” added Lazzara.

Keep an eye on these ‘overvalued’ housing markets as the housing boom implodes

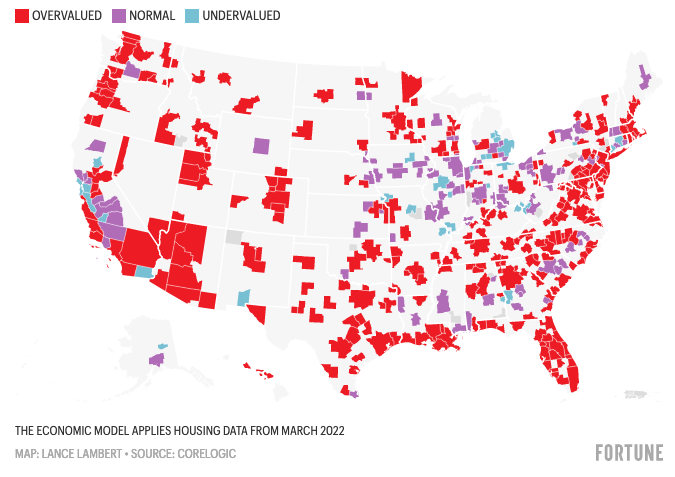

Fortune says “Simply put, the pandemic housing boom is ending“. And cites CoreLogic’s map, which has at long last updated to reality, and shows 2/3s of housing markets as overvalued. Thankfully, they do note this graph reflects sales data from March and we’re in May.

Housing Market Boom ‘Is Over’ As New Home Sales Implode

Forbes has a stronger posture on the boom this time, stating that the housing market boom is over. New home sales surprised analysts, “plunging 16.6% below the March rate”.

They note Pantheon Macro’s Ian Richardson says, “In short, the party is over.” and points to the steep drop in mortgage purchase applications as of late.

They also share that Comerica Bank’s Bill Adams forecasts the roughly 20% price increases of late should fall to the low single digits by the end of next year.

Ready to Buy a House? Just Wait a Few Weeks

On a surprising pivot, Connor Sen who was quite bullish in the past, wrote an analysis in WaPo telling buyers to wait. He states 3 reasons:

For people looking to buy, there are three good reasons to wait.

The first is that we’re exiting the seasonally-strongest period of the year…

The second is that for the first time since the pandemic, the market is softening…

The third reason is that with the overall economy showing signs of weakness, longer-term interest rates have actually been declining in recent weeks, which is just starting to show up in mortgage rates.

Interesting turnaround there.

RE Industry

Homeownership has always been a good “hedge” against inflation

Realtors are sending their clients encouraging notes to keep them interested in buying. One user shared a note he received from his realtor’s agency, which tries to sow a little FOMO.

Today’s inflation may be creating a better outlook for buyers, as it tends to reduce competition for homes. And the equity earned by homeownership has always been a good “hedge” against inflation.

Attempting to time the real estate market is tough. … So, if you’re waiting for interest rates or home prices to fall before buying, you may end up waiting for years while you miss out on the economic and personal benefits of homeownership.

Anecdata

Some deep thoughts from reddit and twitter.

“Prices will stop skyrocketing but they’ll continue to increase more slowly.” – Homebuyer when asked if we’re in a bubble.

“Cash on the sidelines since the Fed pumped a lot of money in the last two years, and how many people are waiting for a slight dip. I think will play a big part on where the RE market will go.” – a homebuyer on why there won’t be much of a correction.

“My market, the Bay Area, is no longer showing a single ‘hot home’ on Redfin. I find this hard to believe.” – a homebuyer noting the sudden absence of “hot homes”, an algorithmic flag on Redfin that probably depends on how many views and likes a home gets soon after listing.

“Sudden, Drastic Change in Zillow Zestimate for no apparent reason?” – Homebuyer sees a $177k drop in their zestimate overnight.

“After the worst year ever after being evicted from a home … to now being approved and FINDING A HOME ANND GETTING FINANCING! We get our keys June 19th and I still can’t believe it.” – First time home buyer

“Just so, so excited and have to scream it out to the void – WE SIGN ON OUR HOUSE TOMORROW!!!” – Another happy first time home buyer

One note about the happy home buyers – there were very many of these. This is a marked difference from just a month ago when FTHB were very deflated and depressed. I really hope that they all made good decisions, but I do worry that more savvy buyers have stepped away and they will be the victims of this bubble.

Disclaimer: I’m an idiot first time home buyer. I’ve never taken an econ class in my life. I’m just sharing what I see and learn as it happens. I am 100% certain I will get things wrong, so don’t take any of this as the golden truth.