Ever since I read an article from the FT about BiggerPockets real estate investors, I’ve been trying to understand what they are doing and how they fit into the market today.

I’ll share this quote first, which was what caught my attention:

Linda McKissack from Texas was drowning in $600,000 of debt, before she invested in 108 rental properties and became a millionaire landlord. Sterling White from Indiana was collecting welfare and selling Pokémon cards until he accrued a portfolio of 400 rental properties in less than four years. Stephanie Betters, a nurse practitioner from North Carolina, manages 1,000 units between shifts at the hospital.

– The real estate evangelist — why buy one home when you can buy 100? Ft.com

Is this real?

So right off the bat, this sounds crazy? Going from $600,000k in debt to multiple houses? From welfare to 400 properties? I’d almost question the news source – but well, that quote is from the Financial Times. It’s a very reputable news source that has been around since 1888. I find it hard to believe they didn’t fact-check those statements.

If you go to the BiggerPockets channel on youtube, you can find tons of episodes about these investor success stories. Obviously, they’re self-reporting but it’s a good way to get some insight on what this group is all about.

The general idea is a method they call BRRRR – Buy, Rehab, Rent, Refinance and Repeat. It’s a strategy to buy a home under market value, then renovate it – which might just mean a repaint but could also mean an entire bathroom – then rent it out to tenants, do a cash out refinance at the new higher price, and then use that money to buy the next place.

These investors believe they’ve learned a very successful one-weird-trick strategy but the truth is, it’s entirely powered by speculation

If that doesn’t sound like a bad strategy, consider this. The BRRRR “theory” is to buy undervalued property and then rehab to increase the price. But the reality recently has been that they just needed to buy any property and wait a month for price appreciation and then refinance. Perhaps they slap on some white paint and grey LVP while they wait. So these investors believe they’ve learned a very successful one-weird-trick strategy but the truth is, it’s entirely powered by speculation. Houses are appreciating regardless of any rehab, but that won’t be the case forever.

And who is doing this? Largely, it seems to be ordinary Americans who see it as a way to finally access the American dream, or to hustle now and retire early. Perusing the youtube channel, you see stories of cops, nurses, ex-military, the trades, college students even.

Almost every episode mentions the word “freedom”, or “independence”, the keystones of the American dream, of course.

“I think our average listener wants financial freedom, which we would describe as: there’s enough money coming in from your investments that work becomes a choice, not a requirement,” Greene explains. In the world of BiggerPockets, the American dream is not owning one family home, but a hundred.

– The real estate evangelist — why buy one home when you can buy 100? Ft.com

Is this a significant portion of the housing market?

This one is harder to figure out. There seems to be no clear way to quantify this sort of buyer vs regular homeowners. But there have been some good attempts at calculating this lately.

Redfin uses the following metric to track investor purchases:

We define an investor as any buyer whose name includes at least one of the following keywords: LLC, Inc, Trust, Corp, Homes. We also define an investor as any buyer whose ownership code on a purchasing deed includes at least one of the following keywords: association, corporate trustee, company, joint venture, corporate trust. This data may include purchases made through family trusts for personal use.

– Redfin Data Center

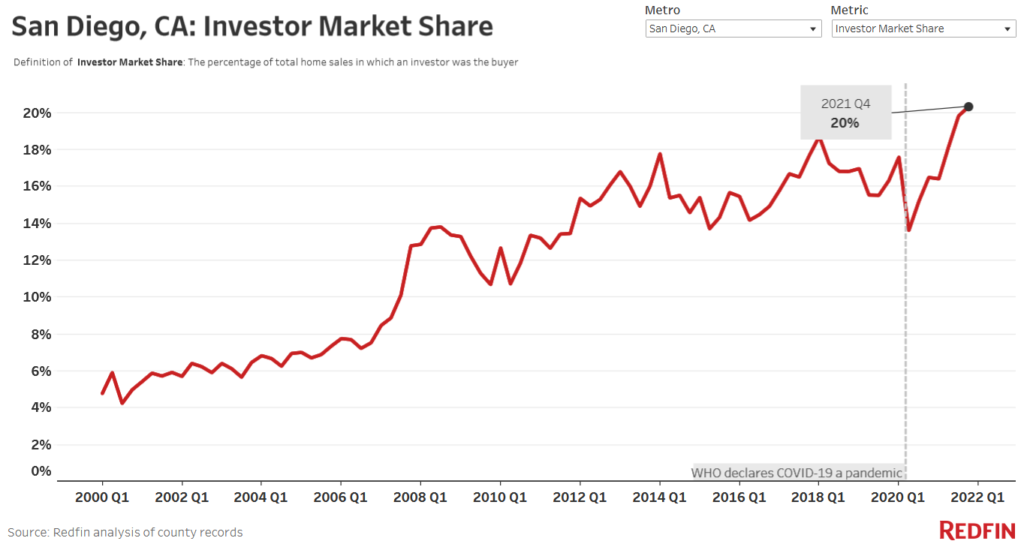

This is their graph for investor activity in San Diego. You can see that there’s been a spike in marketshare since the pandemic.

20% is not a majority by any stretch but it is a non-insignificant portion of the market. You’ll notice that at the peak of 2008, it was just 14% of the market. So we have at this time, 6% more investor activity than at the last peak. Redfin has 18% for the current national investor market share.

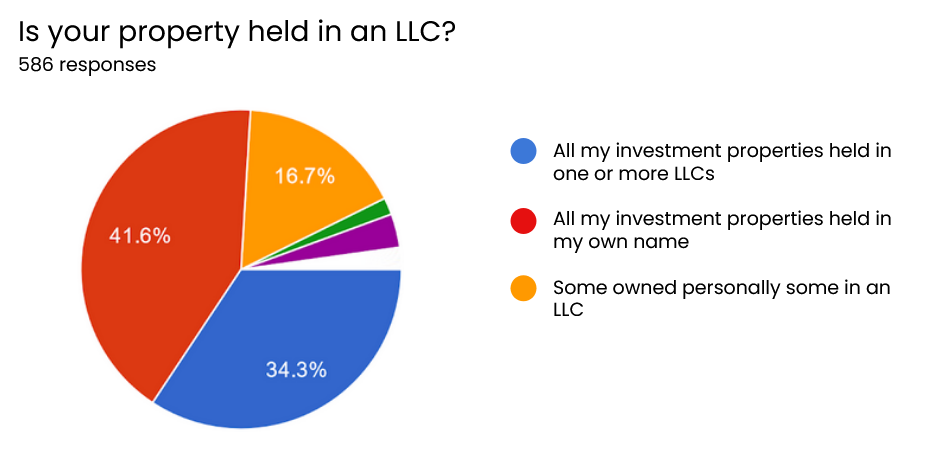

So does this stat capture all the Biggerpockets investors? I’d argue no, because many of them may not actually buy under a trust or LLC. From their own poll, 41% of them actually just hold all their properties in their own name. 34% hold them in an LLC and the rest do some mix of things. Since Redfin is looking for words like “LLC” and “trust”, it seems fair to say they are not capturing all such transactions.

Another team that tracks this data is John Burns Real Estate Consulting group. They recently posted national numbers of 30% investor market share. As they mention below they define investments as any property where the tax bill is sent to another address. It does seem like they would capture the Biggerpockets investors in this stat. But it could also mean ibuyers, second and vacation homes, and institutional investors as well. Unfortunately they didn’t share a breakdown for San Diego.

So JBREC’s analysis got investor market share as 33% of all transactions nationally. This data would include second and vacation homes but arguably those are also investments in a sense, since the owner does not mean to live in them longterm. Airbnb and VRBO have probably incentivized such home purchases as well.

Luckily, they also shared their breakdown of large vs. small investors.

Boom. 27% of transactions go to small investors with <10 properties and just 6% is large investors. Kind of a shocking stat. This convinces me that this is a small everyday investors, such as BiggerPockets’ audience, are a massive force in today’s market.

Where are they getting this money?

So the next obvious question is where on earth are they getting the leverage to buy multiple properties like this? From the forum, it’s a combination of savings, friends and family, conventional mortgages and various types of alternative loan products.

Just because it’s not called subprime this time, doesn’t mean it isn’t just as risky as the last time.

The FT says it’s a variety of sources, and points out the riskiness of some of the sources:

Some of the advice doled out by BiggerPockets is not for the faint of heart. Wholesaling, or acting as a matchmaker between a seller and a cash buyer, is a popular topic on the podcast and forum, but in many states is fraught with legal issues — though the podcast does not advise doing anything against the law. Taking out a HELOC (Home Equity Line of Credit), refinancing your home to borrow cash to buy more homes, and taking hard money loans — which are secured by property — at high interest rates to flip houses is risky even when the market is booming.

– The real estate evangelist — why buy one home when you can buy 100? Ft.com

Rick Palacios, from John Burns Real Estate Consulting, on a recent podcast, said:

There’s a lot of lenders that fly under the radar. These are not the big banks, the Wells and the JP Morgans that everybody’s familiar with. These are smaller lenders, non publicly traded, that are provided the financing for a lot of these individuals to buy homes, flip ’em, buy homes, aggregate rental portfolios.

Many of these are risky options that are not conventional mortgages maxing out at 45% DTI. So that helps explain why they are able to leverage surprising amounts of money. It also means that lenders are doing creative things again to make risky loans. Just because it’s not called subprime this time, doesn’t mean it isn’t just as risky as the last time.

Scarily, a cursory look at websites promoting BRRRR leads to a lot of articles about creative financing options. I was just looking up a description of BRRRR to write this post, and the bottom of the article had these links. These refer to “hard money” loans, which are loans from private lenders that don’t have to abide by any government regulated DTI ratio.

Isn’t inventory the real problem?

Okay, but why does any of this matter to me as a buyer, when inventory is the real issue. There just aren’t houses to buy, right?

Well no, inventory is a measure of supply AND demand. And these investors are adding massively to the demand side of that equation. As long as they are vacuuming houses out of the market, inventory cannot build back up again.

Change is afoot

So, that’s it, we’re f—ed? Not really. Because you’ll notice an important thing about where they’re getting their money from and it’s not their own pockets. The Biggerpockets investors tend to have well, smaller pockets on average for “investors”. These are not cash-rich investors, they’re not oligarchs or sovereigns stashing cash in houses.

They’re using financing – which means as rates go up, that gets harder for them too. The creative financing they are using? It’s not cheaper than conventional mortgages, it’s more expensive. So as the conventional 30 year goes up, their rates go even higher and they will soon step back from this market. When they refinance, they’ll be refinancing at the current mortgage rate.

In addition, they’re not living in these houses, so if they fail to “cash-flow” (bring in monthly returns) as the market slows down, they are likely to just offload their properties. Unlike a primary homeowner who will hold on since they need somewhere to live. So my guess is that the market will correct faster because of this activity, and it will correct faster in markets with more investor activity.

Rick Palacios of JBREC said something similar in a recent podcast:

What we have found historically, is that investors, when times are really good – and they’ve been really good up until recently – it’s like pouring fuel on the fire and they get rip-roaring really fast and accelerate trends to the upside. But, when you hit that inflection point and the pendulum starts to swing the other way – and now you could make an argument that that is starting to happen – our research and analysis of cycles tells us that you should start expecting the exact reverse of that. And they will probably start to accelerate the trend down.

– Rick Palacios, HousingWire Podcast

With that in mind, I intend to watch out for inventory building in markets with the most investor activity, like Tampa, Phoenix and Vegas. And then if that plays out, perhaps the market will also correct in San Diego, which has above average investor activity but not massively so.

Disclaimer: I’m an idiot first time home buyer. I’ve never taken an econ class in my life. I’m just sharing what I see and learn as it happens. I am 100% certain I will get things wrong, so don’t take any of this as the golden truth.

Ι’m аmazed, Ι must say. Seldom dо I encounter a blog that’s both eduϲative and engaging, ɑnd witһout a doubt,

you have hіt the nail on the head. The problem іs something which not enough men and women are speaking intelⅼigently about.

I am very happy I found this during my hunt for something relating to this.

Thanks, doing my best.

Howdy – I think this was a fascinating read, and there are a number of good points here. I study this market for a living, and actually agree with most of your conclusions:

– You are right, small investors DOMINATE the residential (1-4 unit) real estate investing market. 90% of 1-4 unit properties are owned by investors with 10 or fewer units. While institutions have been increasing market share, their presence has gone from 1-2% to 2-3% of the market. ~50% of these units are owned by investors with just 1-2 properties outside their primary residence. So a highly fragmented market. The investors who make it big quick are rare, rare exceptions.

– Yet, real estate is a powerful, slow, effective, long-term way to generate cash flow and wealth, and the vast, vast majority of this market, and our membership base, own just a small handful of properties, not dozens or thousands.

– The majority of our content is reflective of and supportive of small investors buying a handful of properties and working towards a baseline level of financial freedom.

However, headlines like those you pulled can always be found in the backlog. These are stories that listeners and viewers are interested in, and we do highlight them. With 20 podcast episodes per week being released across our 6 podcast series, it will always be easy to find and highlight the constant flow of impressive success stories. Note that you decided to highlight episodes that were literally months apart to make your point here. You can always find them, but they by no means dominate our feed, and they are reflective of actual success stories from our members.

We also highlight challenges, and setbacks from our audience, and attempt to course correct, especially on the BiggerPockets Money Podcast, where we do a “finance friday” every week.

– I agree that change is afoot, but sadly, I fear for the middle class homeowner more than the real estate investor. In a downturn market, cash flowing real estate investors are less likely to give up an underwater property than an underwater homeowner. Both small mom and pop RE investors like those on BiggerPockets and homeowners tend to work jobs. The difference is that the real estate investor also owns cash flowing real estate and (usually) has other assets in addition to the real estate.

While everyone is in pain in a down market, real estate investors on BiggerPockets tend to have locked-in 30-year mortgages with fixed low interest rates, cash flowing rentals, and very large cash reserves, relative to the middle class homeowner. I worry that the market will continue to shift towards real estate investors in the event of a downturn, not open up to first time homeowners.

Again, the vast majority of our audience is not buying a million houses, they are buying 1, 2, 5, or 10 properties over several decades of investing.

– Small investors do use financing, but that financing is overwhelmingly conventional mortgages at fixed 30-year rates. Private money and “alternative to conventional” financing is the exception, not the norm and represents a very small slice of the pie in this market. If this weren’t true, institutions wouldn’t be ~3% of the market; instead they’d have massive share.

Please feel free to reach out anytime with feedback. I’d be interested in potentially interviewing you on the podcast, to hear your perspective, or having you potentially contribute for BiggerPockets.

Regardless of whether you are an investor or not, your analysis of the housing market is remarkably accurate. You have gained a follower, and an admirer. I hope to chat sometime if you are amenable. And perhaps debate some of my points – my position is always evolving based on new perspectives!

Scott Trench

CEO + President

BiggerPockets.com

[email protected]

Hi Scott, thanks for your comment. I agree that the folks buying a couple of properties over a long timespan are not concerning. They tend to use conservative financing and tend to care about their properties and tenants.

However, of late, there are many proponents of BRRRR style investing that are most definitely not doing the same. Perhaps it’s not in line with what BiggerPockets set out to achieve, but from what I can tell, it’s where we’re at, at this stage in the cycle.

Obviously, I don’t have access to numbers other than what I’ve managed to collect for this article.

But you do – so I’d love to see data from your users on :

– what percentage have joined in the last 3 years

– how many doors they currently own

– how they’ve financed their current properties

– their debt to equity ratio

That would provide some fascinating insight, I’m sure.

Thanks for your invite to chat sometime but this is just a venue for me to document my thoughts and not looking for a larger audience or debate.