When I first started looking to buy, I thought the realtor was supposed to, legally, be looking out for my best interest. I thought I could trust their guidance, after all they’re the “buyer’s agent”, right? Very soon, I figured out I was foolish to assume that.

Hear me out, It’s not that real estate professionals are all dishonest but the way they get paid is essentially a conflict of interest. On top of that, they have to be relentlessly optimistic about the housing market. It’s almost a prerequisite for the job. In the end, humans are good at confirming their own biases when they need to.

It is difficult to get a man to understand something when his salary depends upon his not understanding it.

– Upton Sinclair

So I like to understand incentives. Whose incentives line up with my needs as the buyer?

What are my needs? Basically I want to

- buy a house that I like,

- with no major issues,

- in the area I want,

- at a price as low as possible,

- that I can sell if I need to.

I want it to be a house I can sell should I want to move to a different city in the future. I don’t expect to move in the next 10 years but I don’t want to be trapped if I do.

I don’t want to buy any house for the sake of buying, I don’t want to buy in an area I don’t like. I most certainly don’t want to overpay. Also, I’d rather not buy a house than make a bad decision.

That’s it, those are my needs, they’re my incentives.

Realtor’s incentive

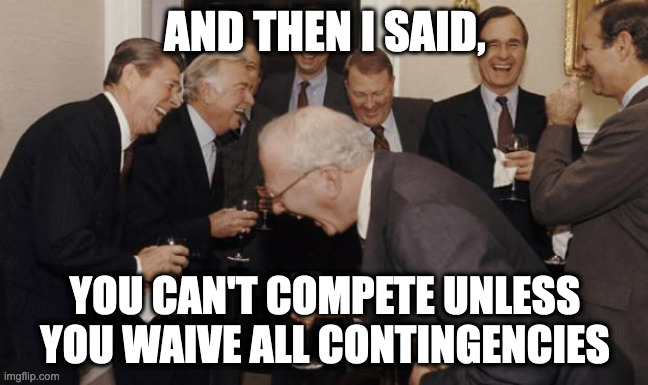

So what’s my realtor’s incentive? Well, I learned my realtor gets paid more if the house costs more. They also don’t get paid if I don’t buy the house. The more time they spend looking at houses with me, the less per hour they are getting paid if and when I do buy a house.

Even more interesting, they actually aren’t paid by the buyer at all, they are paid by the seller. The buyer gets their services for free! Always remember, if you aren’t paying for the product, you are the product. The seller is paying the buyer’s agent to deliver … me, the buyer.

So the higher the price of the house, the better deal for the realtor, the worse deal for me.

The less time spent selecting and vetting the house, the better deal for the realtor, the worse deal for me.

So clearly, their incentives are flat out opposite to mine.

Of course, you can say realtors work on recommendations, so they don’t want you to end up in a house you hate. But really, that’s just about managing expectations, isn’t it?

Always remember, if you aren’t paying for the product, you are the product.

All they have to do is convince me that I made a good decision. That’s not that hard. I learned a long time ago that the more money people spend on a thing, the more they are convinced they made the right decision, because no one likes to feel like a chump. Throw in some solid FOMO about being priced out forever and everyone feels relieved they got any house at all.

Lender’s incentive

What about my lender? They’re taking the risk of lending me this immense amount of money to buy a house. If I default or foreclose, the house is theirs. If I overpay, now they have a house they paid too much for. Surely they don’t want me to get a risky loan on a crappy house I might fail to pay on, right?

Except as we saw in 2008, it’s not the lender that takes on any risk. They sell that loan right away to the financial markets. So no, they actually don’t care. They get paid whether you eventually default on that loan or not. They just want the volume, the more mortgages, the higher the mortgages, the more they get paid.

As long as they don’t do something outright illegal, they’re not taking on any risk. There’s even a name for this . It’s called moral hazard. It was a big issue with lenders in 2008.

“What Burry couldn’t understand was why a person who lent money would want to extend such a loan. “What you want to watch are the lenders, not the borrowers,” he said. “The borrowers will always be willing to take a great deal for themselves. It’s up to the lenders to show restraint, and when they lose it, watch out.”

– Michael Lewis, The Big Short

So, incentives.

The higher the mortgage, the better pay for the lender, the worse deal for me on total price.

The higher the mortgage, the better pay for the lender, the more stretched my affordability, the more risky for me.

Again, nope, their incentives are the opposite of mine.

Read more here on the scary loans people are getting into.

Appraiser’s incentive

So I haven’t got to the point of appraisal but I was thinking, well at least I’ll find out if they think the house is worth it? It’s their job to ensure that the house is actually worth what it sells for, right?

When appraisers know the contract price, they appraise the house on average 4% more than if they didn’t know it.

In fact, mortgage loan officers often say “You can’t overpay for the house. You’re going to get an appraisal.” That is such a comforting thought! Someone who is a Certified Professional will give me a gut check on this decision before it’s final.

As it turns out, again, not really. Appraisers know the contract price (the price you offered) when they do the appraisal. So they are influenced by it and will corroborate it, unless it is WAY off base. When appraisers know the contract price, they appraise the house on average 4% more than if they didn’t know it.

Read more: The Untold Truth of Home Appraisals

So you can overpay and the appraiser will sign off on it. But actually, incentive-wise, the appraiser does seem to be the only one whose incentives don’t outright conflict with the buyer.

They don’t get paid more if it appraises higher, they don’t get referred by the realtor (although they do get selected by the lender). In fact, in this market, they have been appraising low as the market skyrockets and they’re getting some flack for it.

So now I hear people say “appraisers are wrong, it’s made up bullshit“, and “their comps are not keeping up with today’s market” and “the fair price of a house is what any buyer is willing to pay for it”.

“We’re running into appraisers not wanting to be flexible with the market,” said one Atlanta-area agent who asked to remain anonymous. “They’re wanting to stick to prices-previous, and the market’s a little bit different now… Appraisers are going to have to be just a little bit more flexible…”

Chicago Agent Magazine

Oh, those pesky appraisers.

So, I learned that appraisers do usually appraise about 4% higher than they should. But if the appraisal comes in lower than I offered, I should really heed their warning.

Home Inspector’s incentive

Finally, there’s the home inspector. Phew, this guy’s gonna save me, right? He’ll climb on the roof and under the house and tell me everything that’s wrong? It’s literally his job. I can sue him if he gets it wrong, right?

Well, let’s look at incentives. Inspectors get paid a flat rate so they won’t get paid more just because the house cost more.

But – usually, a realtor will recommend an inspector to the buyer, since why would a first time home buyer have an inspector lined up? I certainly have never needed the services of one before.

So the inspector gets paid by the buyer but really, needs the realtor to call them again the next time. If the inspector kills the deal, maybe the realtor won’t recommend them to their next client.

The buyer might call them on the next house… but how many houses is a buyer going to buy in their lifetime, 2? 3? How many deals can the realtor get them? Many. Look at the reviews for inspectors – the majority are from realtors NOT buyers.

Their incentive is to keep the realtors happy, so they get more recommendations. If the realtor is happy because a deal closed on a not-so-great house, more deals for the inspector, worse deal for me.

Well, I mean, but I can sue them right? Well, yes for the price you paid for the inspection. Good luck chasing down that $600 while you pay for $30,000 in repairs on the home.

What’s a buyer to do?

So what’s a buyer to do, literally everyone involved in the process is more interested in keeping the real estate industry booming and not in getting me the right home?

My only answer is to select them all separately through recommendations and research, don’t rely on your realtor to supply them for you.

I didn’t get the realtor my loan officer recommended, I won’t get the home inspector my realtor recommends. I got them all myself from different sources so at least I know they don’t have any particular relationship already. And then, I vet what they tell me by reading up online. It’s not much but it’s the best I can do with this information asymmetry.

Side note: I recently learned you can get a real estate attorney, who is supposed to be on your side. Some states require an attorney in fact. California does not, but I did find this an interesting piece of information.

Please know, I’m not saying that everyone in real estate is evil. Most people are not. But I do believe in the power of incentives. Humans are fallible and biased by nature, and they will act according to their underlying incentives. I’ll end with another quote from the Big Short.

Back in 1995, Munger had given a talk at Harvard Business School called “The Psychology of Human Misjudgment.” If you wanted to predict how people would behave, Munger said, you only had to look at their incentives…

– Michael Lewis, The Big Short

“Well, you can say, ‘Everybody knows that,'” said Munger. “I think I’ve been in the top five percent of my age cohort all my life in understanding the power of incentives, and all my life I’ve underestimated it. And never a year passes but I get some surprise that pushes my limit a little farther.”

Disclaimer: I’m an idiot first time home buyer. I’ve never taken an econ class in my life. I’m just sharing what I see and learn as it happens. I am 100% certain I will get things wrong, so don’t take any of this as the golden truth.

Consumer advocates first called the real estate industry an informal cartel more than 30 years ago and this Fall marks the 30th anniversary since Ralph Nader first called for a long-overdue Consumer Movement in Housing!

https://bit.ly/Nader_RECartel_1992

Regulators, under authorization right up to the White House’s executive order (July 2021) maybe at the start of a new era of consumer protection in real estate. How can we work together towards that end, and as your insights above demonstrate, a Homebuyer Bill of Rights?

https://bit.ly/WTF_ConsumerREv_MeetUp

It is a well funded cartel. Please reach out to me… I would like to chat regarding bringing data like this to more people. Thanks… Erik

What were you thinking, Erik?

Been following your articles and reddit for many months.

Recently bought a home.

My realtor saved me about the same amount of money equal to his commission. He was a life saver and someone who I could trust completely.

If you want his info plz let me know! (In SD)

Thanks for your offer! I have a realtor and really do like him, but I’ll reach out if I need to. I do still think it’s important that people understand how the incentives line up. So many people think it’s the realtor’s job to get them a good deal. It’s not, and you’re lucky if your realtor genuinely tries to do that for you. As yours did.

You are so right. I have been following the market for two years now.

It’s basically a mafia business. They control the supply and demand by plugging houses in and out, creating FOMO. I’ve seen houses going into the market multiple times and not selling because it was wrongly overpriced, they unlist it, and then six months later, the house shows up back in the market at a way lower price for this time to try and create a bidding war. I was following a house for over 40 days, and the realtor refused to send an offer 120k below the asking price. I’m so fed up with this system; it’s a wholly rigged scam. It is an arranged circus where you get to be the clown.