When I first started looking into housing, the clear message I got from all directions was that there was a drastic housing shortage. Since the last housing crisis, we have severely underbuilt and there are simply not enough houses for people to live in.

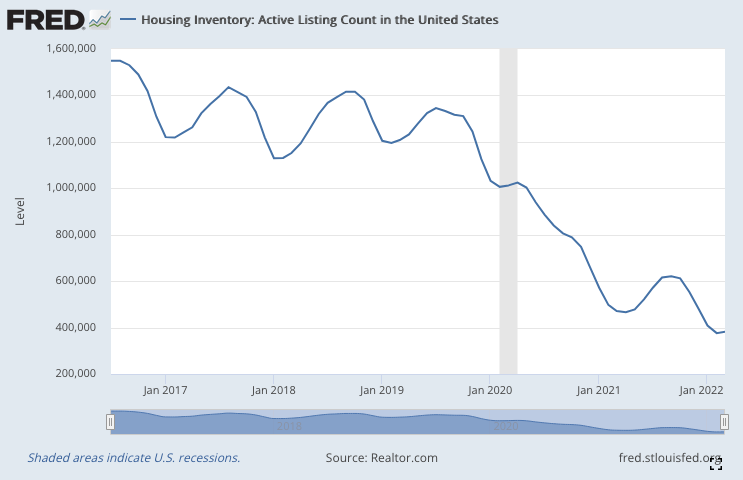

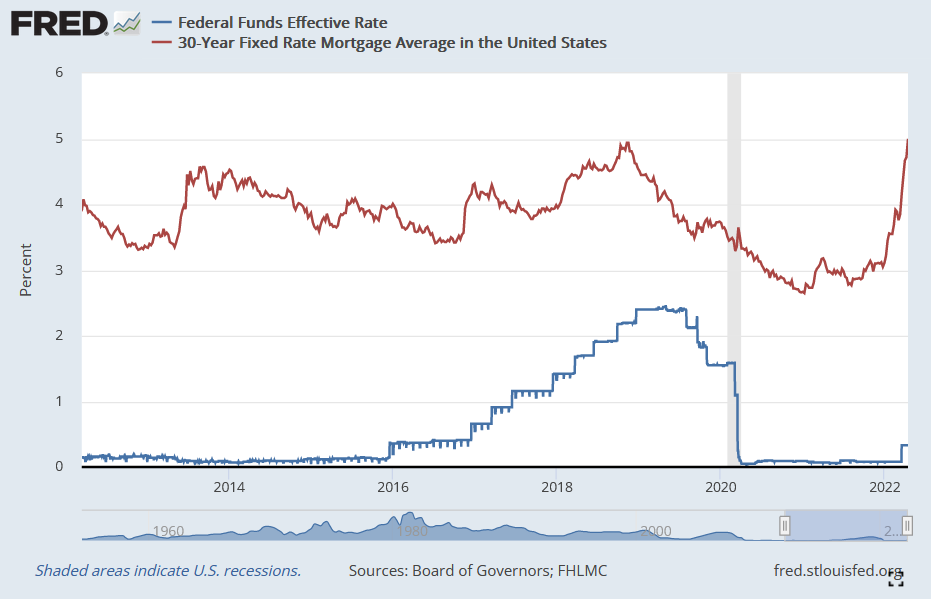

The graph that gets passed around is this one:

But over time and research what I learned was, that this only shows a drop in inventory, not supply. Inventory is not a pure measure of housing supply, it is a measure of supply AND demand. It’s what’s left on the market after sellers add to the market (supply) and buyers subtract from the market (demand).

So if inventory doesn’t tell us if there’s a housing shortage, what does?

Is there a Housing Shortage?

So what is the truth behind the “housing shortage” as it pertains to supply of homes vs population? Turns out this is a very difficult question to answer.

Housing supply is ultimately a localized problem. You could have exactly the right amount of houses but it could be in all the wrong places.

NAR (National Association of Realtors) believes the housing situation is dire and the US housing market is short 5.5 million homes.

Ivy Zelman believes we are not drastically undersupplied, “production is ahead of normalized demand and estimates of a housing deficit are grossly exaggerated.”

John Burns Consulting also believes “current conditions are not the result of a supply problem due to years of underbuilding” and believes we are short just 1.7 million homes, a shortfall that will soon be covered by construction that’s already in progress.

The short of it is, there is no simple answer.

In fact, even if you were to answer the question nationally of whether we have too few or too many houses, the answer would be meaningless because housing supply is ultimately a localized problem. You could have exactly the right amount of houses but it could be in all the wrong places.

Going back to Inventory

So this is why we look at inventory. Because it’s what we have, it tells us how hot the market is. It has meaning, but it doesn’t mean supply. It doesn’t tell us how many houses there are for people to live in, but it tells us how many houses are available to buy.

Isn’t that the same thing? Not really, because a true housing supply shortage can only be fixed by building more homes. But an inventory shortage can be fixed by reduced demand.

So, let’s skip the housing supply question. And focus on inventory.

It is true, there has been a massive inventory drop across the nation since late 2019, but more stunningly since May 2020 – one which almost every housing market is experiencing. A lack of inventory causes prices to go up as there are more buyers than sellers for homes.

So why did inventory drop? For a number of reasons including COVID, WFH, monetary policy, demographics etc. A more important and simpler question to ask then, is:

Is this a new normal?

Is the inventory drop we’ve seen since May 2020 systemic and likely to persist here on out?

Or is it transitory and likely to correct?

Here is that drop in inventory nationally again.

Inventory falls due to two inputs – an increase in demand and a decrease in supply. This graph represents some combination of these two inputs. To understand if this is the new normal, we should talk about both. Breaking those down, we have the following components of supply and demand.

Demand

- Renters deciding to buy a home increases demand

- Investors buying homes to rent increases demand

- Homeowners buying second homes increases demand

Supply

- Building homes increases supply

- “Hunkering down” (homeowners refusing to sell) reduces supply

Demand: Renters buying

Household formation

Let’s start with demand. Specifically with household formation. The most significant way for demand to grow is for renters to enter the real estate market.

Does it make sense that this category of demand spiked after covid? Absolutely. Renters who previously spent 4 waking hours a workday in their home, now found themselves spending 12 hours. They were forced to work alongside partners, children and roommates in perhaps small and non-ideal homes.

While families found they needed more space to work, roommates also found themselves navigating new arrangements related to safety and comfort levels in a pandemic. Everyone desired more outdoor space. So this category of demand went up.

However, this demand is also transitory. As people go back to work, the pressure to buy a house with extra rooms and outdoor space evaporates. Households who made it through the pandemic together no longer feel pressure to split up and spread out. Increase in demand, Transitory.

Low mortgage rates, increased affordability

Another cause of increase in this demand, was ultra-low mortgage rates. People who perhaps would normally have waited to buy a house for a few years, jumped in to take advantage of historically low mortgage rates. The Fed buying trillions of MBS meant banks pushed those low rates down to unseen levels.

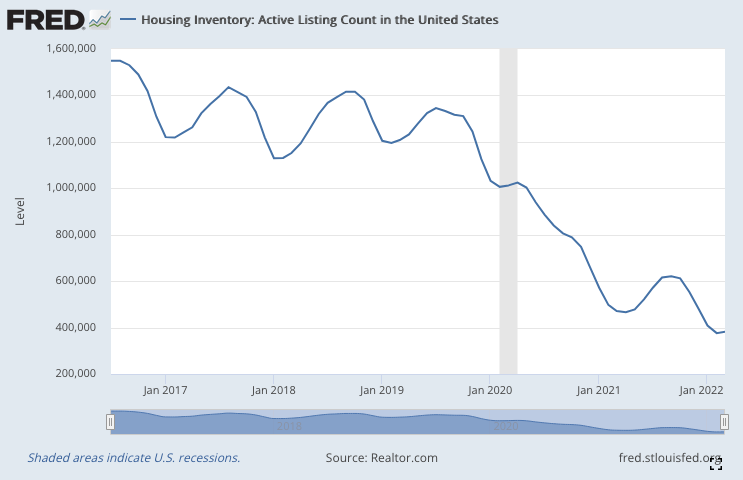

This is why inventory started to fall in late 2019 actually. The Fed abandoned its attempt to hike interest rates (see blue line in the graph below) and started to drop them again.

But again, as mortgage rates hit the highest point in a decade (5.25% around now), this demand is also under significant pressure. The Fed has only increased the Fed funds rate by .25% so far and yet mortgage rates have risen a full 1.5% in the last month. Increase in demand, Transitory.

As seen in the graph above, the last time the Fed had to raise rates to 2.5% for mortgage rates to get to 5%. This time we’ve seen that rise in response to a .25% increase. This will crush demand for housing.

People saved up during Covid

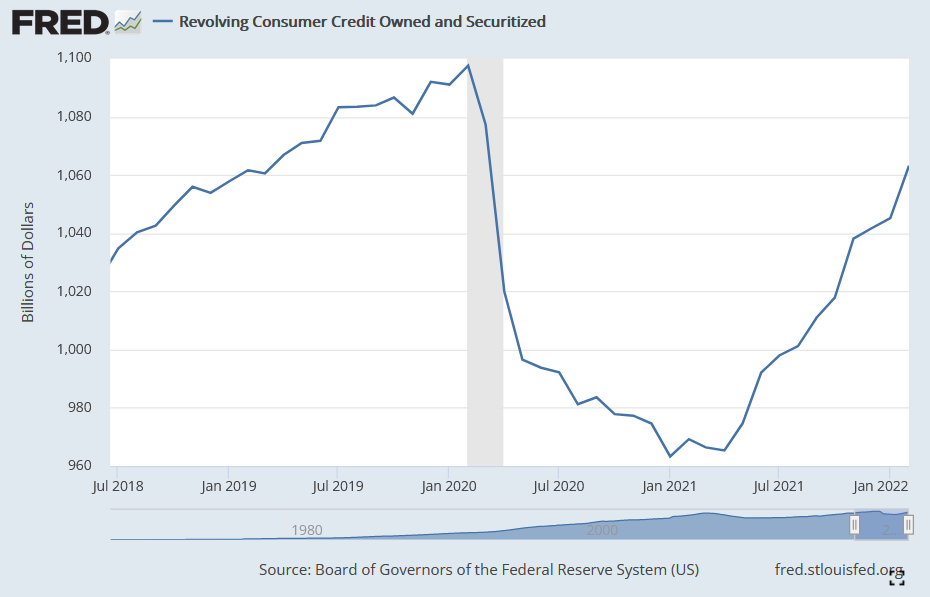

To add to low rates, the student loan forbearance, stimulus checks and covid lockdowns meant renters were able to catch up on a lot of savings and reach their downpayment goals. Household savings and balance sheets looked stronger than ever. Credit card debt plummeted in 2020 due to government policies such as stimulus and loan forbearance.

However, again, this improvement has been massively eroded more recently by inflation and other spending, and the rollback of covid era policies. This graph of revolving credit card debt illustrates it well. So again, Increase in demand, Transitory.

Millennials reaching prime buying age

Finally, there’s the demographic pressure of millennials hitting the market. It’s clear that the millennial cohort is a huge number, and they are hitting prime homebuying age. However, this is a slow growing wave and nothing about this demand should have changed significantly compared to pre-pandemic.

In 2018-early 2019, home prices stalled out and even fell. Millennials were already hitting homebuying age and yet, even in always-hot markets like the Bay area, the housing market had stalled.

Plenty of buyers attended open houses in the final few months of 2018, but the tire kicking wasn’t followed up by purchase bids, Swartz observed.

“There was a price correction,” Swartz said. “It is not a competitive market right now, so buyers are wondering if prices will continue to go down.”

– Bay Area housing slump: Home sales tumble, prices go flat – CNBC

What was different back then? Even unemployment was low and the economy was strong.

The economy in the nine-county region remains strong. Over the 12 months that ended in April, the number of jobs in the Bay Area increased 2.5 percent — far ahead of the growth of the California job market of 1.6 percent over the same one-year period.

“Interest rates are still great, the economy is still chugging along, the unemployment rate is very low in the Bay Area,” said Will Doerlich, broker-owner of Realty One Group in Livermore and Pleasanton.

– Bay Area housing slump: Home sales tumble, prices go flat – CNBC

Were there more homes in total supply? No. If anything, actual supply would have been lower then as building of new homes has since kicked into high gear. More on that later in this post.

While it doesn’t explain the inventory drop by itself, the demographic story is definitely not transitory. We have a few more years before the wave of millennials subsides. Increase in demand, not Transitory

Supply: Investors buying homes to rent

Next up, is investors buying homes to rent. There are two types of investors here – “Wall street” or large institutional investors, like Blackstone, and “Mom and pop” or retail investors.

Thankfully, this is a share of demand that is being tracked. JBREC has the following graph for investor interest nationally, which include both small and large investors, including second homes.

Now, is investor activity transitory? Aren’t they just going to use cash and buy everything while rates are up? Well, while the boogeyman of wall street investors looms large, research points to that being a small part of the market. A much larger percentage of homes was bought by small investors.

Read more to learn why Small investors are the new risky business

The question is whether these investors will double down or step away as mortgage rates increase.

Rick Palacios of JBREC believes they will sell as fast as they’ve been buying:

What we have found historically, is that investors, when times are really good – and they’ve been really good up until recently – it’s like pouring fuel on the fire and they get rip-roaring really fast and accelerate trends to the upside. But, when you hit that inflection point and the pendulum starts to swing the other way – and now you could make an argument that that is starting to happen – our research and analysis of cycles tells us that you should start expecting the exact reverse of that. And they will probably start to accelerate the trend down.

– Rick Palacios, HousingWire Podcast

Redfin reported that the market is already cooling – and the effect they’re seeing in some markets is coming from investors, as the ROI is limited at higher prices.

Buyers using traditional financing are worried about being priced out, but all-cash buyers are rubbing their hands together, thinking that high rates will dry up the competition and they will be able to swoop in and bid unopposed,” said Redfin Austin real estate agent Chris Lefforge. “However, the biggest effect I’m seeing right now has been on investors. With prices rising so fast, the return on investment is falling fast. Higher monthly payments are starting to push Austin-area investors into other less expensive markets or out of the market altogether.”

– Home Sales Fell 4% in March as Buying Costs Shot Up – Redfin

So it seems investor demand is proving to be more transitory than embedded. Increase in demand, Transitory

Demand: Homeowners buying second homes increases demand

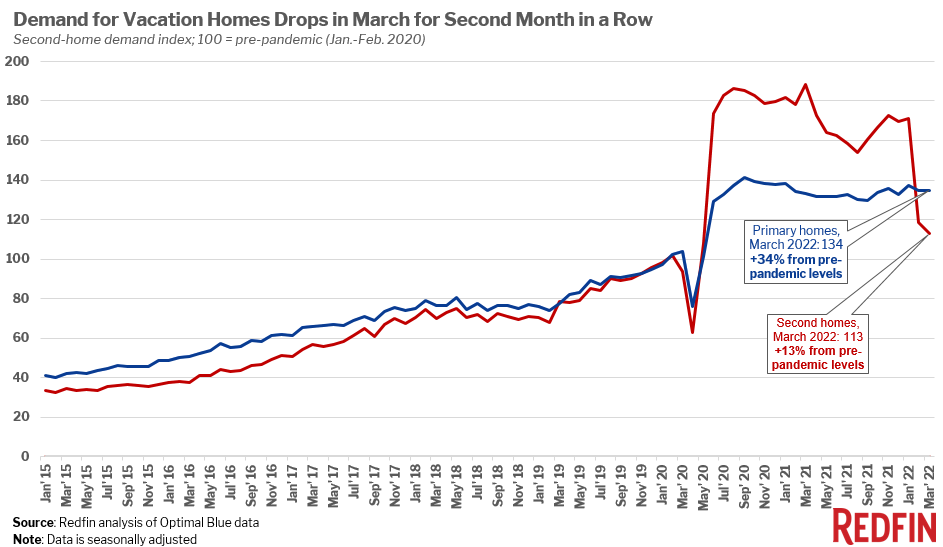

This was a huge source of demand after covid. Many homeowners bought a second house or vacation home to get away from the city, while keeping their original home. As you can imagine, a large number of people choosing to suddenly own two homes increases demand.

From Fortune.com,

For those who can afford it, buying a second home has almost become a trendy pandemic-era pastime. Demand for vacation homes surged during the pandemic once white-collar employees were allowed to work remotely. Backed by then-low interest rates and pandemic-era savings, many sought second homes in the mountains, near the seashore, or in the suburbs.

– Soaring mortgage rates just hit another housing market niche | Fortune

You can see the demand here in this data from Redfin. At its peak, homeowners were buying 85% more vacation homes than they had ever bought before. That is a drastic change in demand. However, you can also see how transitory it is, as it’s already plummeting back down in the last month. Increase in demand, Transitory

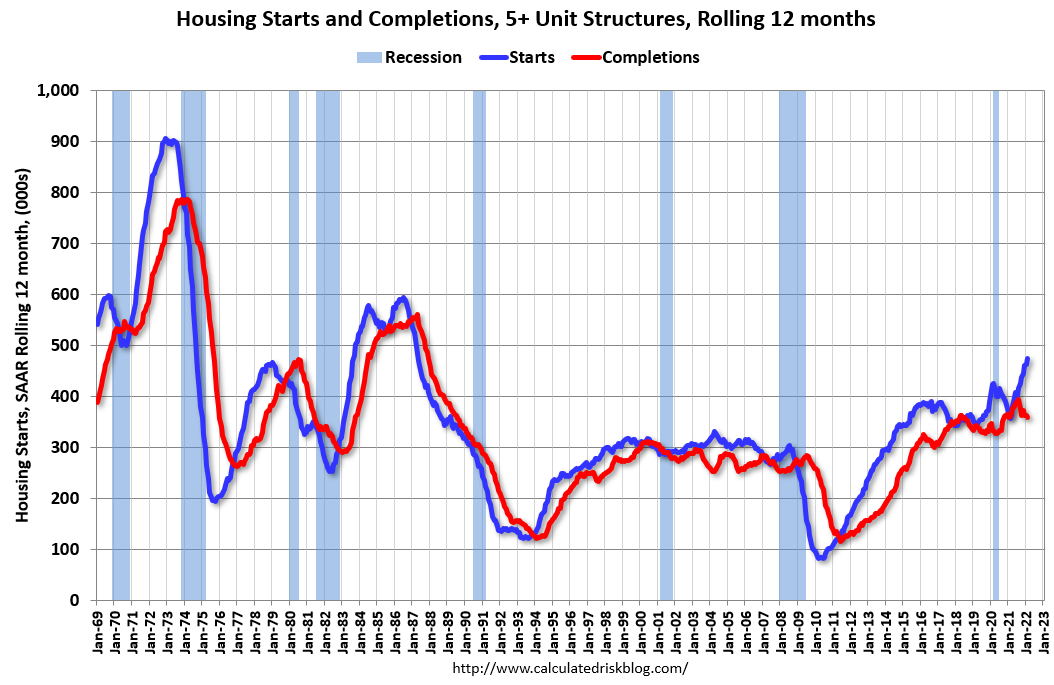

Supply: Building homes

Building homes increases supply, and there is a lot of argument over whether we have been building too much or too little. But if we’re just looking compared to the pre-pandemic days, we are building more, and continue to build more.

While we may still have a shortage, it cannot account for the inventory drop seen after the pandemic. This housing shortage is also blamed for the massive price increase. If we were so short before, we should have seen the dramatic price rise in the years before the pandemic as well.

So is this transitory? Well, we are building a lot now, and supply chain issues have slowed us down, but ultimately, compared to pre-pandemic, we are increasing supply. Increase in supply, not transitory.

Supply: Sellers hunkering down

Immediately after covid started, there was an argument that sellers were just hunkering down due to covid. Now the narrative is that they’ll hunker down due to low rates. But this is a bit of a false narrative.

Sellers hunkering down don’t really reduce supply because in most cases, they would have also bought a house after selling their own. Certainly, there are some effects in terms of how many “starter homes” become available if homeowners are not trading up to bigger homes. But overall, most sellers are also buyers, resulting in a net zero effect on the market. Net Zero.

Conclusion

So going back to our original questions –

Is this a new normal?

Is the inventory drop we’ve seen since May 2020 systemic and likely to persist here on out?

Or is it transitory and likely to correct?

No, this is not a new normal. It very much should correct over the next 2 years.

Almost every component of demand and supply experienced massive short term effects due to the Fed, Covid and the resulting fiscal and the monetary policy. I think it’s fair to assume these short term effects will start to dissipate, if they haven’t already, as the Fed’s tightening actions take effect.

The only non-transitory components are increased building which will continue to improve, and a demographic increase in demand, which is no different that the period prior to the pandemic and can’t account for the surge in prices since. Everything else is a transitory effect that will wipe out of the market as the measures implemented for covid get reversed.

Disclaimer: I’m an idiot first time home buyer. I’ve never taken an econ class in my life. I’m just sharing what I see and learn as it happens. I am 100% certain I will get things wrong, so don’t take any of this as the golden truth.