We had a stunner of a morning yesterday when the BLS (Bureau of Labor Statistics) released its CPI (Consumer Price Index) value of 9.1%. That’s actually the highest inflation we’ve recorded since 1981. It was also beyond expectations, which were set at 8.8%.

The thing that confuses me (and a lot of other folks) about CPI is that housing and rent inflation have seemed so low in the last 2 years, compared to what we’ve really experienced. The reason is because it’s calculated differently than you might expect.

Don’t know what CPI is? This is a good primer.

Calculating shelter costs

Shelter inflation is split into two components – owned housing and rented housing. Owned housing is calculated by asking owners what they think they would rent their house for. I know, insane.

Rented housing is calculated taking both asking rents and continuing rents, which is why it differs from other rent estimates you might see. Those usually cover only asking rents.

The reason for this, is that they correctly attempt to estimate on average what people are spending on housing, not just those who are buying or renting a new place in that month. Everyone who is already in a home is paying older rents, older mortgage payments, so on average, the shelter component of CPI is lower than what you see “in the market”.

Finger-in-the-air guess? Housing likely peaked in April, so OER will stay inflated until October.

Fed won’t drop rates until we’re past that hump.

So, with that in mind, you can see why, even though shelter is a huge component of CPI (22%), it’s not as straightforward as prices go up → CPI goes up.

Owned Shelter

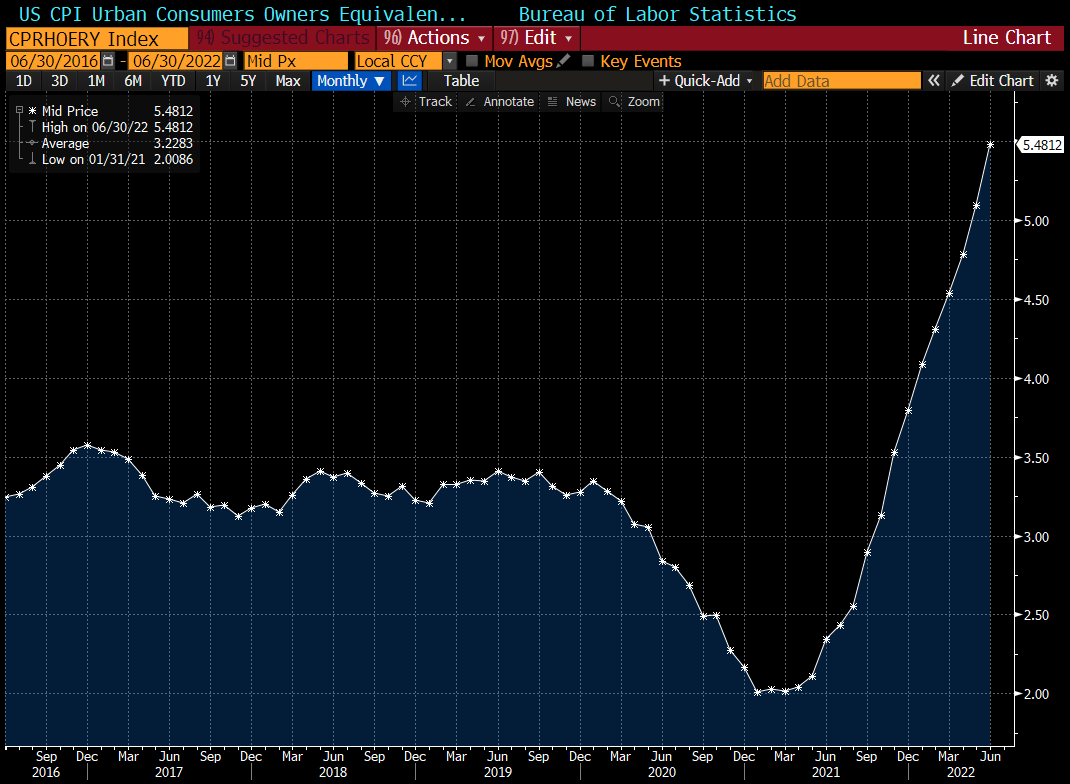

Check out how OER (Owner’s Equivalent Rent) has varied over the last 2 years. This graph was posted by @BChappatta and shows the OER readings as calculated by BLS.

Notice that the COVID dip actually registered in the OER in Dec 2020? That’s a full 7 months after house price appreciation dipped. That is quite a lag, that’s how long it took to show up in the CPI.

Similarly, notice that until Dec 2021, the OER inflation did not exceed “normal” readings similar to the pre-COVID years. It wasn’t until early 2022 that housing price inflation really started showing up as a problem in the CPI.

So if you think about it, even if the Fed were to crush home prices today, they would probably not be able to see the effect for months in CPI. Which means they likely cannot pivot for a while. Finger-in-the-air guess? Housing likely peaked in April, so OER will stay inflated until somewhere around October. Fed won’t drop rates until we’re past that hump.

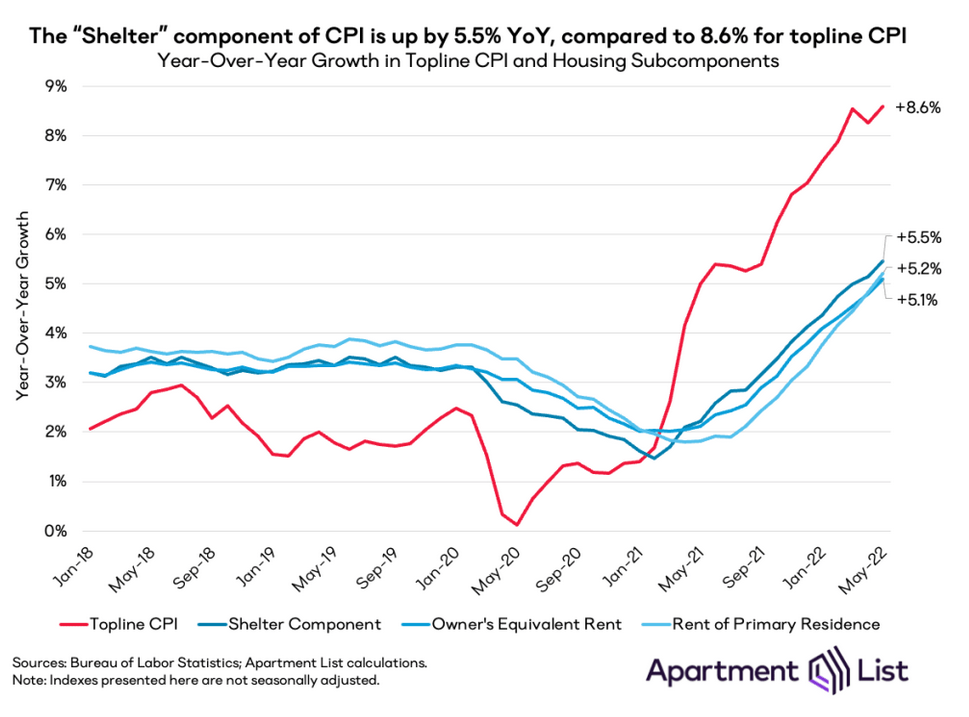

Rented Shelter

Rented shelter also has a delay compared to asking rents. Using the COVID dip again, ApartmentList estimates the lag in Rent CPI to be about 7-8 months, about the same as owned housing. This means that rent inflation will be high for about 7 months from the peak.

I’m not sure where the peak in rent is, ApartmentList thinks we are past it but I haven’t seen enough data around this. At any rate, we can see that rent inflation will also hold up the CPI for a few more months.

Excellent article from ApartmentList on how rent affects CPI.

However, there are other components to CPI to shelter and those might correct sooner.

Here’s another chart that helped me understand how this CPI reading breaks down into its components, and how owned and rented shelter contribute.

Note, these aren’t the weights that are used monthly, these are the weighted results of June’s inflation reading. Altogether, shelter contributed 1.7% of the 9.1% reading, not insignificant.

That said, gasoline and other, contributed a hefty 5.8% and both of those could drop sooner based on commodity prices that are already falling. So there is a chance that they’ll correct enough to balance out the rising shelter inflation, but my feeling is the Fed won’t pivot while shelter CPI is still rising. At any rate, we’re definitely getting another .75% (at least) at the end of July.

Disclaimer: I’m an idiot first time home buyer. I’ve never taken an econ class in my life. I’m just sharing what I see and learn as it happens. I am 100% certain I will get things wrong, so don’t take any of this as the golden truth.

Fantastic write-up, coming back to this article looking at Powell’s statements for the September FED meeting expecting CPI Shelter to remain high for some time and why that doesn’t mean they’re also saying home prices will increase during that time as well.

Thanks! Yes, that seems to have caused some confusion. Home prices are already falling (according to latest Case Shiller even) but the CPI calculations won’t register this for a while. This is also why some journalists (Liesman I think) asked Powell if he would stop raising and “wait and see” at some point, so that these lagging indicators could catch up.